Security and surveillance systems are becoming critical to manufacturing plants and factories by helping to address the theft of raw materials, the theft of IP, and the tampering of equipment, machinery and cargo. They can also serve as an effective monitoring tool for overseeing assembly line production and worker safety.

A Micron/Repon case study

Repon, a manufacturer of high-quality ball bearing slides used in various industries including server- and rack-mount systems, office/home furniture, white appliances, tool boxes and medical carts, recently deployed an advanced security and surveillance system—an edge storage solution—at their newly built manufacturing plant in the south of Taiwan. Their system architect, Apogear, integrated Micron’s industrial microSD cards into this solution.

In the case of Repon’s deployment, 24x7 operational requirements needed to be met while minimising the risk of data lossIn this case study, we discuss why Repon implemented an edge storage solution and how they will benefit—from a total cost of ownership (TCO) perspective—with Micron’s industrial microSD cards.

Why edge storage?

The simple answer: to enhance overall system reliability. In the case of Repon’s deployment, 24x7 operational requirements needed to be met while minimising the risk of data loss.

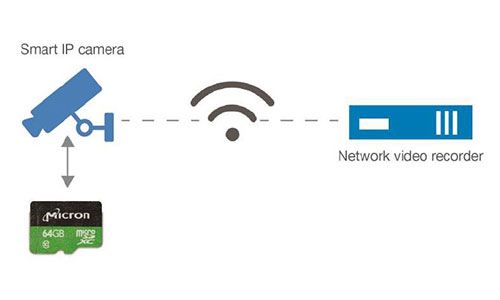

Edge storage—the recording of video and storing it at the camera—provides recording redundancy, helping to reduce the risk of data loss. By storing a second copy of recorded video in a microSD card, edge storage provides backup in case there are any issues with the primary network storage (including network reliability issues).

In the event the primary network storage goes offline, video continues recording in the microSD card. The recorded video can then be synchronised to network video recorders (NVRs) or video management systems (VMS) after the primary system is restored.

Selecting the right industrial microSD Card

Historically, memory manufacturers sell the lowest quality NAND flash (media grade) memory to the memory card market. While this quality of NAND can be sufficient for storing pictures and video (where data is written to once and stored), using it in microSD cards for edge storage (where data can be written and rewritten to often) is not recommended.

|

| Figure 1: Edge Storage for Recording Redundancy |

Edge recording with memory specifically designed to support 24x7 recording over a long period of time requires a new understanding of how that memory is made— from silicon selection, to manufacturing flow, to product design, to qualification testing.

Many microSD cards available in the market today are intended for consumer use in digital still cameras (DSCs), car dash cams, or home cameras; they are not designed for commercial and industrial edge storage in IP video surveillance cameras. As such, edge storage can often be viewed as ‘unreliable’ by system integrators and installers.Users may not understand that the lifetime and quality of a microSD card can vary significantly depending on the quality of the card

Users may not understand that the lifetime and quality of a microSD card can vary significantly depending on the quality of the card. Selecting the wrong quality of microSD card can result in costly field failures, often occurring within months after deployment.

The importance of selecting the right memory card in an edge storage solution is illustrated in Apogear’s analysis of Repon’s edge storage solution. The analysis also shows the cost savings Repon anticipates from using Micron’s Industrial microSD cards in their solution.

Project cost analysis and assumptions

Apogear’s total cost of ownership (TCO) analysis (below) is reflected in relative percentages, and not on actual dollars and cents given regional and vendor differences. To create an understanding of the project scale, the TCO was estimated at approximately $850,000 USD over a three-year contract term in regards to deploying a 600-camera system at Repon’s manufacturing facility using Micron Industrial microSD cards.

|

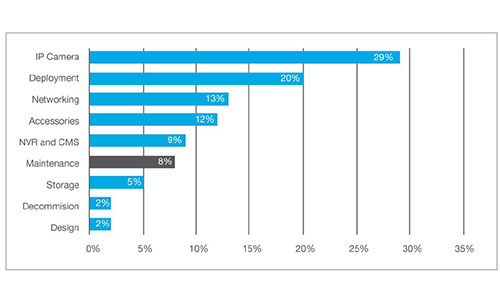

| Figure 2: Cost Distribution Data, as provided by Apogear |

Figure 2 provides the percentage of costs during the estimated lifecycle of the edge storage system. The cost per system phase amounts to:

- Equipment cost (68%) - the cost of an IP camera, networking equipment (switch, cables, etc.), accessories, NVR and central monitoring system (CMS), and storage (HDD and microSD card).

- Deployment cost (20%) - the cost of installation, configuration and integration.

- Design cost (2%) - the cost of consulting and system architecture design.

- Maintenance cost (8%) - the cost of planned, regular and additional maintenance services.

- Decommission cost (2%) – the cost of dismounting and recycling equipment at the end of its lifetime

Why Micron’s industrial microSD card?

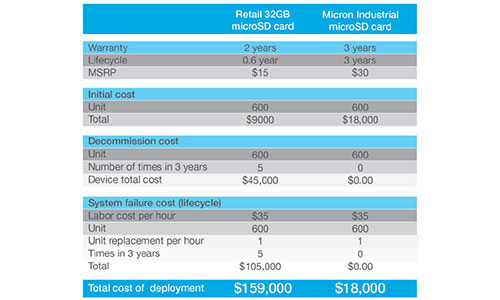

Micron’s solution is backed with a 3-year product warranty under professional surveillance use casesThe importance of product reliability is often underestimated when considering the cost of maintenance and field service. When a retail-grade microSD card fails, the card must be replaced. Not only are there direct costs of sending a crew to service and replace the card, but there are also outage times that can result in significantly more costs.

By implementing Micron’s industrial microSD card, which is designed for 24/7 video surveillance edge storage usage, it is estimated that Repon will see an approximate $141,000, or about 16%, improvement in TCO compared to using an off-the-shelf retail microSD card1.

High reliability and quality, lower maintenance and replacement costs

Micron’s industrial microSD card supports 3 years of high-quality continuous 24/7 video recording with a quality specification of 2 million hours mean time to failure (MTTF) and 0.44% annualized failure rate (AFR) —2X better than a typical HDD today. Additionally, Micron’s solution is backed with a 3-year product warranty under professional surveillance use cases, helping to keep maintenance and replacement costs to a minimum.

|

| Figure 3: Maintenance and Replacement Cost Comparison, as provided by Apogear |

Advanced features minimise risk of data loss

Micron’s industrial microSD card contains firmware optimised to provide stable performance for 24x7 high quality video recording with minimal frame drops.Micron understands the unique needs of this market and has developed deep application-level expertise

In addition, Micron’s industrial microSD card offers a health monitoring feature for IP camera integration that reports card usage and lifetime remaining. Systems can integrate this feature into their software to alert predictive maintenance service. Micron’s industrial microSD card comes with password protected lock/unlock features to keep the device secure.

Conclusion

The move to edge recording and high endurance storage is happening across the Industrial IoT landscape. Targeted solid state storage solutions are emerging, and with it, new entrants into the security and surveillance ecosystem. As a leader in automotive and industrial memory solutions, Micron’s new product line of industrial microSD cards are built to meet the requirements of this industry.

As a trusted advisor to its embedded customers for more than 25 years, Micron understands the unique needs of this market and has developed deep application-level expertise and a portfolio designed with that in mind. Most importantly, it brings to the market a mindset to deliver sustainable value to its customers.

Learn why leading casinos are upgrading to smarter, faster, and more compliant systems