Compare AC-APP-64R-VM with AC-APP-128R-ENT2 (2)

| Contact manufacturer | Contact manufacturer | |

| Standalone/ Networked/ PC |

Networked

|

Networked

|

| Reader Type |

Card Swipe

|

Card Swipe

|

| Max No. of Controllers |

512

|

512

|

People also viewed these products

Related Videos

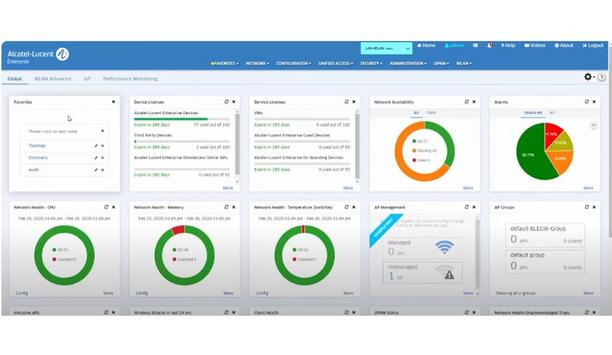

OmniVista 2500 - Locator Historical Data Search

OmniVista 2500: Dashboard favourites and external apps

OmniVista 2500: Dashboard large data sets

Latest Access control system case studies

The system allows for remote key management. substantially increasing nursing efficiency and security of controlled drugs Security expert Abloy UK has supplied S...

Park management needed an affordable solution to stop unauthorised use, and installed SMARTair™ At a Slovakian campsite in the Tatra National Park, unautho...

A leading orchestra, admin staff, 200 contractors, and thousands of music fans all need access at various times. Auditoriums, rehearsal rooms, wardrobes, offices, a sauna, the cant...

One system, one card

DownloadAligning physical and cyber defence for total protection

DownloadUnderstanding AI-powered video analytics

DownloadEnhancing physical access control using a self-service model

DownloadHow to implement a physical security strategy with privacy in mind

Download